From Your Laptop to the Trading Floor: Career Pathways from Retail Forex into Institutional Roles

Let’s be honest. The retail forex world can feel…isolating. You’re often trading against the very firms you might want to work for, armed with a fraction of the data and capital. But here’s the deal: that experience isn’t a dead end. In fact, the skills you’ve honed in the retail trenches can be a powerful, if unconventional, launchpad into the institutional arena.

Making the leap from a solo retail trader to a role at a hedge fund, prop trading firm, or bank is less about a magic trick and more about a strategic translation. It’s about reframing your story, building a bridge between your self-taught expertise and the structured, risk-aware world of institutional finance. Let’s dive into how you can build that bridge, piece by piece.

Translating Your Retail Skills into Institutional Language

First things first. You need to understand what institutions actually value. It’s not just about being “good at trading.” It’s about a specific, demonstrable mindset.

The Non-Negotiables: Discipline and Risk Management

Every retail trader talks about risk management. But can you prove it? An institution needs to see a near-obsessive focus on capital preservation. This means having a documented, repeatable process for every single trade—entry, exit, stop-loss placement, position sizing. Think of it like a pilot’s pre-flight checklist; no matter how skilled you are, you never skip the steps.

Your ability to articulate your risk framework is crucial. Instead of saying “I risk 2% per trade,” be prepared to discuss drawdown controls, correlation analysis across your portfolio, and how you adapt sizing during periods of high volatility. This is the language they speak.

From Gut Feeling to Quantitative Edge

Institutional roles demand objectivity. That intuitive “feel” for the market you’ve developed? It needs a backbone of data. Start quantifying everything. Was your win rate on EUR/USD breakouts actually higher during London sessions? Can you back-test that assumption, even with simple tools?

The goal is to move from saying “I think this pair will go up” to “My analysis of order flow and volatility compression suggests a 60% probability of an upward move, with a defined risk-reward ratio of 1:2.5.” It’s a subtle but monumental shift in presentation.

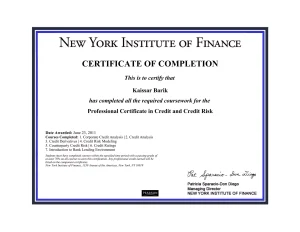

The Credentials Game: Certifications and Formal Learning

Okay, let’s talk about the elephant in the room. A retail track record alone is rarely enough to get an interview. Certifications act as a signal—a way to validate your knowledge and show commitment. They fill in the gaps that your solo journey might have left.

| Certification | Why It Matters | Best For Transitioning Into… |

| CFA (Chartered Financial Analyst) | The gold standard. Covers ethics, portfolio management, advanced analysis. Shows deep, broad financial knowledge. | Hedge Fund Analyst, Portfolio Manager, Research Roles. |

| FRM (Financial Risk Manager) | Deep focus on risk measurement, modeling, and regulation. Perfect if your edge is in risk management. | Risk Analyst, Quant Risk, Treasury. |

| CAIA (Chartered Alternative Investment Analyst) | Specializes in hedge funds, real assets, private equity. Demonstrates niche knowledge of the institutional landscape. | Fund of Funds, Hedge Fund Due Diligence. |

| FMVA (Financial Modeling & Valuation Analyst) | Practical, hands-on modeling skills in Excel. Less theory, more direct application. Great for showing technical chops. | Trading Analyst, Junior Associate roles. |

You don’t need all of them—that’s overkill. Pick one that aligns with the specific institutional career pathway you’re targeting. The CFA, while brutal, honestly opens the most doors. It tells a hiring manager you speak their language fluently.

Building Your “Institutional-Grade” Portfolio

This is where many retail traders stumble. Your MyFxBook statement showing a 50% return last year might raise eyebrows, and not the good kind. Institutions care about process, consistency, and risk-adjusted returns more than raw profit.

What to Include (And What to Leave Out)

Think of your portfolio as a professional dossier, not a boast sheet. It should contain:

- A Detailed Trading Philosophy Document: A 1-2 page “white paper” on your approach. Are you a macro discretionary trader? A systematic trend follower? Define it clearly.

- Robust Performance Analytics: Don’t just show equity curves. Include metrics like Sharpe Ratio, Sortino Ratio, maximum drawdown, win rate, average win/loss ratio, and volatility metrics. Use tools like Python, R, or even advanced Excel to generate these.

- Trade Journal Samples: Excerpts that show your thought process for specific wins and losses. A deep post-mortem on a losing trade is often more impressive than a highlight reel of wins. It shows intellectual honesty.

- A “Model” Portfolio or Research Report: Create a sample analysis on a current macro theme (e.g., “The Impact of Divergent Central Bank Policy on AUD/JPY”). This demonstrates your ability to think fundamentally and communicate ideas in a structured format.

The Networking Bridge

You know this, but it bears repeating: people hire people. The path from retail to institutional is notoriously opaque—job postings often aren’t public. You need to build connections.

Start on LinkedIn, but go beyond just connecting. Comment intelligently on posts by analysts at firms you admire. Attend virtual or in-person meetups (look for “quant finance,” “macro trading,” or “CFA society” events). The goal isn’t to ask for a job outright. It’s to ask insightful questions, share your perspective from the retail front lines, and slowly shift your identity in their minds from “retail trader” to “serious market participant.”

Where to Aim: Potential Landing Spots

Your first institutional role might not be as a lead portfolio manager—and that’s okay. Be strategic about entry points.

- Proprietary Trading Firms: Often more meritocratic. They care less about pedigree and more about your simulated or live track record. Your retail experience is directly relevant here.

- Hedge Funds (Junior Analyst/Assistant Trader): You might start supporting a senior trader, running their analytics, managing risk books, and gradually proving your market sense.

- Banking (Sales & Trading Desk Support): Roles in trade processing, risk analytics, or as a trading assistant can get your foot in the door of the institutional ecosystem.

- Quantitative Research (If you lean technical): If you’ve taught yourself Python to back-test strategies, you could pivot into a junior quant researcher role, helping to code and test models.

The journey is a marathon, not a sprint. It requires packaging your solitary craft into a form that a team-based, compliance-heavy world can recognize and trust. It’s about proving that the resilience, self-sufficiency, and market intuition forged in the retail world aren’t just liabilities—they can be, with the right framing and foundational upgrades, your most unique and powerful assets.